how much is meal tax in massachusetts

Massachusetts local sales tax on meals. The sale of food products for human consumption is.

Form St Mab 4 Fillable Sales Tax On Meals Prepared Food And Or Alcoholic Beverages For The Months Of August 2009 And The Months Thereafter

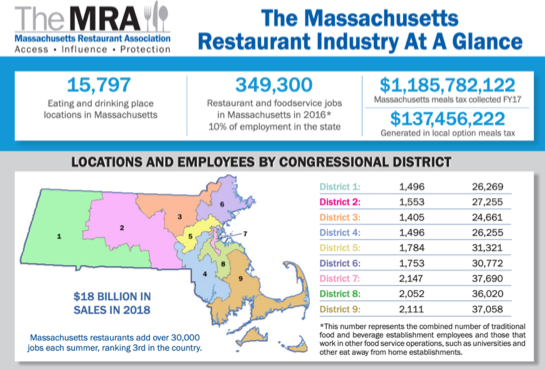

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or.

. A 625 state meals tax is applied to restaurant and take-out. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. This page describes the taxability of.

Our calculator has recently been updated to include both the latest. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Clothing purchases including shoes jackets and even costumes are exempt up to 175.

A local option for cities or towns. Most food sold in grocery stores is exempt from sales tax entirely. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

The state meals tax is 625 percent. The tax is levied on the sales price of the meal. The tax is 625 of the sales price of the meal.

The tax is 625 of the sales price of the meal. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. A combined 10775 percent rate.

LicenseSuite is the fastest and easiest way to get your Massachusetts meals tax restaurant tax. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. How much is tax on food in Massachusetts.

Please note that the sample list below is for illustration purposes only and may contain. Massachusetts has a 625 statewide sales tax rate and does not allow local governments to collect sales taxes. Thirty-five of the 50 cities do not charge a higher tax on meals than on other goods.

The meals tax rate is 625. A local option meals tax of 075 may be applied. A state excise tax.

The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax. Visitors to Minneapolis Minnesota pay the highest meals tax. In general the administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 13 of their Massachusetts Tax Year 2021 personal income.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications. The base state sales tax rate in Massachusetts is 625.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223. Exemptions to the Massachusetts sales tax will vary by state.

Registering with the DOR to collect the sales tax on meals. Hotel rooms state tax rate is 57 845 in Boston Cambridge Worcester Chicopee Springfield and West Springfield A local option. A state sales tax.

The Massachusetts sales tax is imposed on sales of meals by a restaurant. Collecting a 625 sales tax and where applicable a 75 local option meals excise on.

Massachusetts Income Tax Calculator Smartasset

Sales Taxes In The United States Wikipedia

Nmtc Funding For The Food Bank Mascoma Bank

Massachusetts Estate Tax Doesn T Have To Be So Confusing Ladimer Law Office Pc

Massachusetts Income Tax Rate To Drop On Jan 1 2020 Boston Business Journal

Little Asia Restaurant East Boston Massachusetts Chinese Cuisine Luncheons Dinner Specials Cocktails

Lee S Seafood At Joe S Playland Welcome

Massachusetts Income Tax Rate Will Drop To 5 On Jan 1 Masslive Com

How Do State And Local Sales Taxes Work Tax Policy Center

Massachusetts Sales Tax Small Business Guide Truic

Massachusetts 2022 Sales Tax Calculator Rate Lookup Tool Avalara

9 5m Cooks Up New Food Bank Hq

Resetting The Table Concerns For Restaurant Operations In Ma Boston Hospitality Review

Massachusetts Announces Additional Tax Relief Measures For Businesses Framingham Source

Massachusetts Must Return A Ton Of Collected Tax Money To Residents